Affordable Housing FAQs 2023

2023 will be a fruitful year for buyers looking to purchase a home under the affordable housing guidelines. Projects like Kuilei Place, The Park on Keeaumoku, and Sky Ala Moana are all launching projects with affordable housing or currently have affordable housing units available. The eligibility rules don't typically change from year to year with the HHFDC (Hawaii Housing Finance & Development Corporation, the agency providing the affordable housing benefits to the developer), though income limits do go up (or down) from year to year. Let's take a look at some of the most frequently asked questions for the affordable housing program in Honolulu.

FAQs

Let's take a look at the Honolulu affordable housing requirements

Let's clear one thing up before we get started, the affordable housing program is not the same as the reserved housing program that is commonly seen with Kakaako projects. The reserved housing program is overseen by the HCDA which is another government agency that is responsible for development in the Kakaako neighborhood. They have some similar eligibility requirements but the programs are different. Below are questions regarding the HHFDC program.

To see if you're qualified, take a look at some of the FAQs for affordable housing below.

What is HHFDC?

The HHFDC or Hawaii Housing Finance and Development Corporation is the agency that oversees all of the affordable housing in Hawaii. They also oversee the financing and development of the actual affordable housing units as well.

What are the benefits of HHFDC's Affordable Housing?

- The program allows eligible and qualified applicants to purchase below market pricing

- The opportunity to own and live in a new construction project in town

What are the income limits for Affordable Housing?

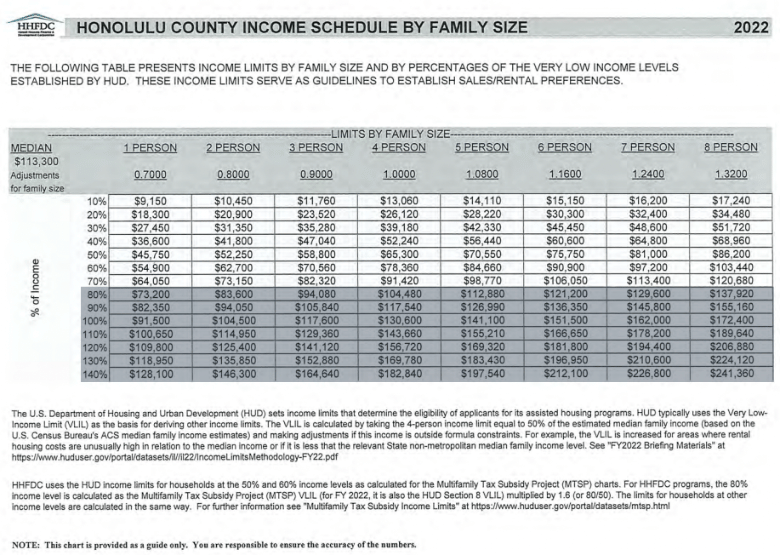

If we're looking at projects coming up next year like Kuilei Place, you'll have to be between 80% and 140% of the Area Median Income (AMI). Find your household size at the top of the chart. Please be aware that some, not all, affordable housing projects have a minimum income requirement. Looking at the chart, for a family of four the maximum income is $182,840. The chart below is 2022 numbers which will most likely be used at Kuilei Place.

As an example, the max income a single-person can earn in a year to qualify is $128,100.

Are you eligible for Affordable Housing?

This is a loaded question and one not easily answered. There are various components that go into determining a buyer's eligibility status as well as understanding if the developer has any specific requirements for their building.

Ultimately it's at the discretion of the HHFDC to determine one's eligibility. Some of the basic requirements are:

- U.S. citizen of permanent resident alien with a valid government issued ID.

- At least 18 yeas old.

- Resident of the State of Hawaii and currently residing in the State of Hawaii.

- Shall physically occupy the unit.

- Does not own a majority interest in a fee simple or leasehold property anywhere in the world.

- Has sufficient gross income to qualify for a loan to finance the purchase of a unit.

One example of developers introducing their own requirements beyond what the HHFDC requires happened recently with Korean developer Sam Koo's two Honolulu Projects, Kapiolani Residence and The Central Ala Moana. With Kapiolani Residence (his first project) as long as you made under the maximum income you were eligible. With The Central Ala Moana you had to be under the maximum income, but also over a minimum income requirement. This eliminated a lot of buyers who are getting help from a family member because if you didn't make a certain amount of money, you couldn't purchase regardless of how much help you could get.

What is the deposit required?

Some projects are 10%, while others only require 5%. Please keep in mind this is only what the developer requires, your loan officer may require a larger downpayment in order to secure a loan. For the project Ililani, only 5% downpayment is required. The downpayment requirement for Kuilei Place is not known at this time.

What is the buyback program?

The buyback program is one of two programs that are imposed on all new HHFDC sponsored projects. In short, the program requires the owner to occupy the unit as their primary residence for 10 years or the duration of the program. The buyback program allows the HHFDC the first right to purchase the unit back in the event the owner no longer can occupy the unit or chooses to sell or transfer unit in the first 10 years of ownership. At the end of the 10 year period, the buyback program goes away.

If you decide to sell the property within the first 10 years you will get 1% appreciation plus any improvements that you've done to the property.

Please keep in mind that not every project has a 10 year buy back restriction. Some projects can be much longer like Sky Ala Moana which I've heard will be 30 years.

What is the SAE program?

The SAE program or Shared Appreciation Program is designed to help fund future HHFDC affordable housing projects. The affordable housing program is providing you the opportunity to purchase a unit at below market prices and to help perpetuate the program, a percentage of your profit will be returned back to the state when you sell.

The sale of your property can only take place after the 10 year buy back period is over. If you're selling within the first 10 years the SAE program does not apply.

The SAE percentage is calculated prior to closing and doesn't ever change. The SAE is due when the unit is sold, transferred, or rented.

How is the SAE amount calculated?

Original fair market value (determined by HHFDC's appraisal prior to closing) minus the purchase price, divided by original fair market value, rounded to the nearest 1%.

$500,000 (Original Fair Market Value) minus $400,000 (Purchase Price) equals $100,000.

$100,000 divided by $500,000 equals 20%

20% is the SAE percentage when you sell. So regardless of what you sell for you'll pay 20% of your appreciation to the HHFDC.

So let's say you purchase an affordable housing unit and your SAE percentage is 20%. After you live in the unit for the entirety of the designated term you decide to sell it. The unit is now worth $800,000 and you initially paid $400,000. Your gain is $400,000 which will be subject to the 20% shared appreciation.

Here are the projects you should be considering:

If you're interested in applying for an affordable housing unit, before you start doing research into what's available and anything about specific condos, I would reach out to a loan officer. Having a deep understanding of your financial situation will determine the best way to move forward on these projects. Perhaps you need to save a little more or that raise you're about to take will push you over the maximum income limit. Having a plan and being prepared will make this entire buying process less stressful and more enjoyable.

Kuilei Place is one project that you should definitely consider if you're looking to purchase something in the near future. Keep in mind that this project is not built yet and likely won't start construction until late next year. The typical build time for a project of this size is 28 - 30 months. So prepare to put down your deposit and being really patient for about four years.

Need a loan officer recommendation? Reach out to me and I'd be happy to put you in touch with one!

Post a Comment