If you're looking for more information regarding "Affordable Housing" please click this link here. Reserved Housing and Affordable Housing are two different programs that have different eligibility requirements. The next opportunity to purchase below market housing will be an Affordable Housing project called Keeaumoku Towers. There won't be any Reserved Housing (below market projects in Kakaako) opportunities for the foreseeable future.

What is Reserved Housing for HCDA?

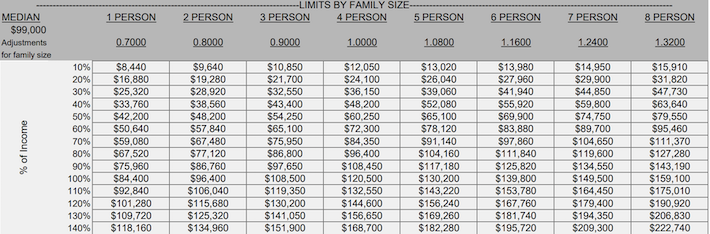

- The Kakaako district in Honolulu is quickly becoming an attractive and convenient residential community that represents a unique housing opportunity for Hawaii residents trying to relocate closer to the Honolulu business district and Waikiki and substantially reduce their daily commute time to work. Reserved housing is designed to provide affordable housing in the Kakaako area for buyers earning less than 140% of Honolulu area median income (AMI) as established from time to time by the United States Department of Housing and Urban Development (HUD). The 2018 AMI is $96,000.00 and 140% of that is $134,400 (for a family of four). All buyers will need to go through a qualifying process to ensure they meet the HCDA reserved housing requirements as well as lender requirements. For a single person the max income or 140% of AMI is $94,100. (see below for full chart)

What is the area median income for Honolulu in 2019?

The area median income for a single person in Honolulu in 2019 was $84,400. 140% of that income is $118,160. If your income is over $118,160 then eligibility for a reserved housing project is unlikely. If you're very close to that number eligibility is still possible, email me to discuss [email protected].

What are the income requirements?

- The Buyer's "adjusted household income" may not exceed 140% of the area median income. For a single person your income may not exceed $118,160.

- The "adjusted household income" refers to the total income, before taxes and personal deductions. This includes anyone living in the primary borrower's household, including, but not limited to, wages, social security payments, retirement benefits, unemployment benefits, interest and dividend payments, but not including business deductions.

- In addition, the buyer's assets (mutual funds, bank accounts) may not exceed 125% of the area median income.

What is shared equity?

- The share of the equity in the reserved housing unit shall be the higher of:

- An amount equivalent to the difference between the original fair market value of the unit and its original sales contract price, not to exceed the difference between the resale fair market value and the original sales contract price; or

- An amount equivalent to the authority’s percentage share of net appreciation calculated as the difference between the original fair market value of the unit and its original sales contract price, divided by the original fair market value of the unit. “Net appreciation” means resale fair market value less original sales contract price and actual sales costs incurred, if any.

- After the end of the regulated term, the owner may sell the unit or assign the property free from any transfer or price restrictions except for applicable equity sharing requirements set forth in 15-22-187 of the Mauka Rules, Chapter 22 document.

- PLEASE CONTACT ME FOR INFORMATION REGARDING EQUITY SHARE

What documents do I need to present to my loan officer?

- 2 years tax returns

- W-2's

- Pay stubs

- Verification of assets

- Gift letter with verification of funds (if receiving assistance with down payment)

Which buildings have reserved housing available?

- Howard Hughes will launch a new Reserved Housing project in the near future though no name or details have been released yet. Check out the Keeaumoku Towers project near Ala Moana for affordable housing opportunities.

What are the buying procedures?

There will be a published announcement in Newspaper outlining the following process:

- Application pickup period

- Lender qualification period

- Application submittal period

- Lottery drawing

- Unit selection

What are the occupancy guidelines?

Your household size will determine what type of unit you are able to purchase. For example, a family of four can purchase a 2 or 3 bedroom home but not a 1-bedroom home. A family of 2 can purchase a studio, 1-, or 2-bedroom home. A single person can purchase a studio or 1-bedroom.

Please keep in mind that the reserved housing at Aalii will only have studio and one-bed units.

How long am I required to live in the unit?

The regulated term for reserved housing units is established based on unit affordability and will range anywhere from 2-10 years. Reserved housing units affordable to qualified persons with adjusted household incomes:

- Less than one hundred percent of median income shall be regulated for ten (10) years;

- One hundred to one hundred nineteen percent of median income shall be regulated for five (5) years;

- One hundred twenty to one hundred forty percent of median income shall be regulated for two (2) years. HCDA may elect to extend the period on a case-by-case basis.

How much is the down payment?

Post a Comment